Merchant Cash Advance

Get £3k to £300k in 24 hours*

- Pay back through future card sales

- Unsecured – there’s no worry

- Same day business funding

Quick Decision with No Obligation

Get £3k to £300k in 24 hours*

Quick Decision with No Obligation

⚠ Beware of scams

We are aware of scams coming from phone and email where people try to impersonate us. We will NEVER ask for any upfront payments. Learn more on what to do and how to protect yourself.

Need a business loan with straightforward, affordable daily repayments? A Merchant Cash Advance, also referred to as a Business Cash Advance, is a new unsecured business loan alternative. It’s a short-term cash injection between £3,000 and £300,000, which works with you to support your cash flow and business needs. Unlike traditional finance products, there is no APR* or hidden costs! You only agree on a simple, comfortable cost that is paid back, typically over 6 to 9 months as a fixed percentage of your future credit card and debit card sales – simple!

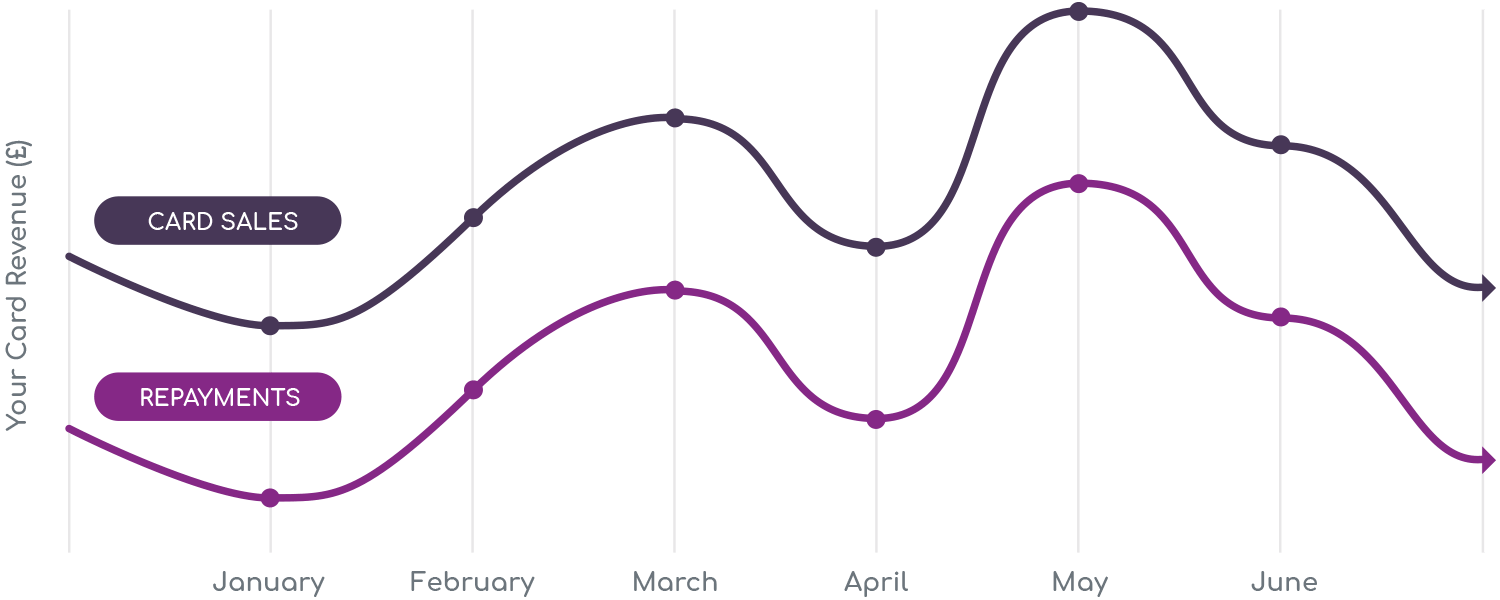

A Merchant cash advance is the UK’s most exciting funding solution for small business and SME’s. Praised by the government as an alternative funding option for UK businesses, it has already helped thousands of people. It’s designed to work alongside your busy and quiet periods. For example, if you have a slow month on your card sales then you only pay back the agreed percentage of those sales. It keeps repayments in line with your cash flow through the good times and bad. The unsecured business loan alternative is repaid only when you make sales on your card terminal (PDQ) machine.

There are absolutely no hidden costs or fees when applying for a merchant cash advance. Complete the simple online application form to get your free no obligation quote today.

Apply NowQuick Decision with No Obligation

With flexible repayments and no fixed term, a merchant cash advance can offer many benefits over traditional bank loans and other forms of business finance.

There’s no need to change your existing card terminal (PDQ) machine, everything stays the same.

You automatically repay when you sell to your customers – There’s no fixed payment terms.

The advance is unsecured, so your business assets are safe.

Any hard cash that your business takes is yours – You only pay back on card sales.

You agree a simple, comfortable cost that you pay back as a fixed percentage of your future credit and debit card sales.

We can process your application 24 hours a day. So if you are struggling for the time from your busy business schedule, you can apply when it’s convenient.

Quick Decision with No Obligation

A merchant cash advance is a relatively new product to the UK financial market, but it offers an array of exciting features for businesses operating in retail, hospitality and leisure. In fact, any business that accepts debit and credit card payments via a card terminal could qualify for a merchant cash advance. The perfect product to help grow your business.

View more examples of business types that could benefit from using a Merchant Cash Advance.

Apply NowQuick Decision with No Obligation

A merchant cash advance is designed for businesses that accept payments for goods and services via a card machine. It essentially allows you to unlock funding against your future card sales. The amount of funds available to you is aligned with your average monthly turnover of card transactions.

Repayments are taken as a set percentage of each sale until the advance is paid off. This flexible pricing structure is tailored at the outset of the arrangement to suit the needs of your business.

The process is fast, simple and straightforward. It's hassle-free, meaning there's no complicated paperwork to complete so you can focus on growing your business.

We just need a few basic details to provide you with your free no-obligation quote. If your business receives payments through a (PDQ) card terminal machine, you could qualify for a merchant cash advance up to £300k. The amount you can borrow is determined by your monthly average card sales and overall volume.

Whether it’s to buy more stock, invest in new equipment or maybe just a cash injection, a merchant cash advance has helped thousands of business customers across the UK get the access to funding they need. After approval, the money could be transferred to your bank account the same day.

Repaying is straightforward and automatic. You agree a comfortable, fixed percentage (usually 10-20%) of your future card sales until the advance is repaid. It couldn’t be simpler! It’s flexible, so in slow times, you pay back less and in good times you pay back faster. All your hard cash income is left alone.

Quick Decision with No Obligation

"We have helped many small business owners across the UK receive funding to grow"

£20+ Million

Total Funded to Businesses

90%

Application Approval Rate

A merchant cash advance is an unsecured cash injection with no upfront fees and no fixed payment terms. You simply and automatically repay a percentage rate of future card takings within a short timeframe, typically six to twelve months. With no fixed repayment terms and no late penalties, the repayments only happen when a card transaction is processed. This means that you will repay faster when you’re busy and less when business is quiet.

Every business is unique, and it is the same with a Merchant Cash Advance. Pricing is tailored to your business and your performance. To get a feel for the cost, take a look at our example below. Remember, apply now and receive an instant, no obligation quote!

Here’s a quick example

A retail business owner borrows £10,000 for refurbishment and agrees to pay back £12,000. On average, the business generates £20,000 per month on card transactions. The owner agrees that 10% of future card processing sales will be used to pay back the advance. The business would pay back £2,000 per month, and it would take approximately six months to repay the total amount of the advance.

£10,000

Advance amount

£2,000

Average monthly cost¹

6 Months

Predicted payback term

£12,000

Total amount repayable

¹ This is an average figure and includes the total cost of the advance.

Pricing is tailored specifically to your business needs, and amounts can change based on your performance. Costs will be clear before signing into the agreement.

Get a free, no-obligation quote today – it only takes a minute!

Apply NowQuick Decision with No Obligation

For more information, please visit our Frequently Asked Questions page.

The amount you can borrow will depend on your average monthly card takings. So, the more you turnover through your card machine, the more you will be able to borrow. Let’s say for example your business averages £5,000 in sales per month on your PDQ machine or merchant gateway. You could qualify for funding to the same amount released via a merchant cash advance into your bank account. In some cases and dependent on risk analysis, the funding offer could equate up to 150% of your monthly card turnover meaning you could receive a larger sum.

The amount of credit as a lump sum available is generally between £3,000 and £300,000, and in some cases, we have helped with higher amounts.

A merchant cash advance is a short-term funding product. The time it takes for you to pay it back is based on your business performance from your credit card payments or debit card payments. When sales are slow, you pay back less, and in good times you pay back faster. Typical repayment timeframes are 6 to 9 months, but can be as short as 4 months and as long as 18 months. Once your business has a positive repayment history, you may be able to top-up your funding, increasing your borrowing amount and extending the term. This will depend on your business affordability and repayment history.

To qualify, your business must be a limited company, partnership or sole trader based in the United Kingdom. You must also accept card payments from customers. This can be via a PDQ machine or online sales through your ecommerce merchant gateway provider.

There are many businesses in various industries that qualify for a business cash advance and all process card payments from their customers. Industry sectors such as hospitality and retail, shops, restaurants, hotels, cafes, MOT tyres and garages are typical businesses that we often see. Many online e-commerce retail businesses also use this type of commercial finance.

Ideally, your business must be trading for approximately three months and turning over more than £2,500 in card sales a month.

Don’t worry if you can’t meet this requirement; we’ll do our best to work with you to find a solution.

Every business is unique, so pricing is unique. The cost of this type of commercial finance is clear and straightforward as it is calculated using a factor rate which gives you a total repayment figure. A repayment percentage of each future sale by card is repaid to the lender until the loan amount is paid off in full by the business owner. There are no other hidden charges or costs associated with this type of borrowing.

To help you estimate how much it will cost, we have created a merchant cash advance calculator. It is intended as a guide to help you estimate the costs associated with this type of business funding option. The calculator allows you to add in the amount you are looking to borrow, the lender factor rate, your monthly card turnover and what percentage of each sale you are comfortable to repay back to the lender.

A lender uses a factor rate to determine the total repayment value of the borrowing. A factor rate is a simple calculation whereby the amount of funding required is multiplied by the factor rate figure (usually between 1.1 and 1.5).

As an example, your business borrows £5,000 based on your sales volume, and the lender sets the factor rate at 1.25. (£5,000 x 1.25 = £6250 total repayable / total cost of finance).

The factor rate is calculated depending on your business trading performance, the sector that it’s in and other risk elements associated with the business. By using our service, you will receive quotes from lenders who offer competitive factor rates, giving you access to the best rates on the market.

There are no fixed monthly repayments. It’s not a traditional cash loan, so there’s no fixed term and no APR. You only pay back a small percentage of your future credit and debit card sales until the advance is repaid. It works with seasonal businesses too where card takings can fluctuate dramatically.

We do not perform any credit checks during the application process, but the provider you have been placed with may perform credit scoring from a major credit reporting bureau. A missed or late payment may affect your credit score.

Having a poor credit history shouldn’t stop you from applying for a cash advance. In some instances, lenders can be satisfied that your application should be considered even with a bad credit history. The main thing is to not let it put you off from applying. What’s more, if you know you have a blip on your credit history you can raise it when you speak to the lender as they will appreciate you being forthcoming with any extra information in order to help with your application.

A 'merchant cash advance' and a 'business cash advance' mean the same thing. They are exactly the same product and offer nothing different in terms of funding options, they just use different industry terms.

Generally, a merchant cash advance works with a wide range of merchant service providers and card payment processors, including, but not limited to:

Yes, it works in exactly the same way for ecommerce businesses as it does for businesses who use standard PDQ merchant terminals. If you use an online debit and credit card processing provider such as Stripe, Worldpay Online, Shopify Payments, Paypal, SagePay, Amazon Pay, Payoneer or any other online payment gateway, you can apply for a cash advance.

It's not a traditional unsecured business bank loan, so there's no fixed term and no APR. Merchant loan advance providers measure their fees as a factor rate. The advance amount you receive is multiplied by the factor rate to determine the total amount you will pay back. You only pay back a small percentage of your future credit and debit card sales each day until the loan has been settled, meaning in slow times, you pay back less, and in good times you pay back quicker.

Each lender could offer you slightly different variations based on numerous factors. From overall repayment values based on their calculated factor rate, to what percentages they will look to take from your daily sales. These are the most common variations which will give you an immediate idea of what to expect. By comparing your quotes from lenders, you will be best placed to make the right choice for you and your business. Using our website will give you the comparison information you need.

A merchant cash advance is not currently regulated by the FCA (Financial Conduct Authority) in the UK. Some of the lenders who offer such products may also provide other conventional forms of funding which may be regulated by the FCA. You can clarify this with any lender who you choose to borrow from, and they will advise if the product is FCA regulated.

We’ve helped hundreds of businesses from restaurants to retail shops get access to funding. Here are some of our customer reviews.

“Found the merchant cash advance to be a great help to our business. Very simple, will use again.”

Cerian

B&B Owner, Manchester

“Very approachable, helpful and keen to do business.”

Caroline

Pub and Restaurant Owner, London

Don’t just take our word for it, read our online customer reviews here

Our providers will have their policies for non-payment, and therefore the customer must check the terms and conditions of the provider they use. Late or non-payment may result in default charges, fees and extra charges. If you have any problems making a payment, you should contact the provider directly.

We are not involved with the collection practices. If you have any problems making a payment, you should contact the provider directly. If you fail to resolve with the provider directly, then your account may be referred to a collections agency.

We are not involved with the decision to renew your loan. Our providers have their specific renewal policies. We encourage you to read the loan agreement terms and conditions specified by the provider we match you with carefully. If you need to renew your loan, please contact the provider directly.