Fast and flexible finance for hair, nail and beauty salons

Are you looking to invest in your hair and beauty salon business? Whether you need funding for cash flow, hiring more staff, stock or salon equipment, we have an unsecured, flexible business loan that's perfect for helping grow your salon.

Works with your card sales

Unlock funding from £3,000 up to £300,000 against your customer card sales.

Flexible repayments

Automatically repay a small percentage when customers purchase by card – There are no fixed payments.

No asset security required

The advance is unsecured, so your business assets are safe.

Fast funding

A quick decision and process mean you can access your money in just 24 hours* after approval.

No hidden costs

The cost of finance is made clear to you upfront. There are no hidden costs, confusing APR’s or other nasty charges.

Apply online 24/7

Apply at any time - We can process your application 24 hours a day.

Quick Decision with No Obligation

Funding to make your hair and beauty business flourish!

Finding the right funding for your hair and beauty salon can be tricky. Traditional banks often have strict criteria, extensive paperwork, and may even ask for a full business plan before giving a simple "yes" or "no."

The good news? There’s an alternative designed specifically for the hair and beauty industry and it's called a merchant cash advance. Unlike a traditional loan, it’s fast, flexible, and easy to access, with repayments linked to your future credit and debit card sales. Payments adjust automatically, so you repay less during quiet months and more when business is busy.

This type of funding can help you expand your salon, invest in marketing or equipment, hire new staff, or diversify your services. With over 63,800 hair and beauty salons in the UK, according to annual industry statistics for 2024 published by the National Hair & Beauty Federation (NHBF), staying competitive requires smart investment to ensure long-term success.

Whether you’re a sole trader or limited company, and need funding for new equipment or to cover short-term cash flow, we’ve helped countless hairdressers, beauty salons, nail technicians, massage therapists, and other beauty businesses access flexible funding, even with bad credit.

Take the first step today and get a fast, free quote through our simple online application form.

APPLY NOWQuick Decision with No Obligation

Uses for hairdresser or salon business funding:

- Purchase essential furniture and equipment such as reception desk, hairdryers, straighteners, basins, salon chairs, sunbeds and more

- Stock up on hair and beauty products and accessories

- Help boost your cash flow levels

- Expanding your treatments and services, for example, sports therapy and massage

- Remodel and refresh your salon interior

- Build a website that includes online booking or eCommerce shop

- Increase your team by hiring beauty therapists, stylists, makeup artists or nail technicians

- Emergency repairs and maintenance

- Add retail shelving, fixtures and displays for beauty products

A hair and beauty salon business loan is a type of unsecured business finance that is designed for hairdressers, makeup artists, beauty salons and any other businesses that trade within the beauty industry. It can be used for many purposes, such as purchasing stock or salon equipment, hiring staff or help to boost your cash flow.

This type of business loan for hairdressers and salons works differently from traditional lending. With a merchant cash advance, repayments are taken through your credit and debit card sales as and when they happen. You agree with the lender a comfortable percentage of future card sales that will go towards repaying the advance.

For example, you charge a client £60 for a hair and beauty makeover, and they pay you by credit card. If you agreed to a 10% repayment with the lender, then £6 would be transferred automatically to the lender as the transaction is made. This continues on your daily sales until the advance is repaid.

Salons and hairdressers can typically borrow 1 to 1.5 times their monthly card sales. For example, if your salon takes £6,000 in card payments, you could receive an advance of around £6,000–£9,000. Get a personalised quote to see exactly how much funding you could qualify for.

No. Unlike traditional lenders, which often require a detailed business plan, a merchant cash advance doesn’t need one. This makes the process faster, simpler, and hassle-free, allowing you to access funding without extra paperwork.

Yes! Even if your personal or business credit score isn’t perfect, you can still access funding through a merchant cash advance. Unlike traditional loans, this type of financing focuses on your future card sales rather than your credit history, making it easier for salon owners to get the money they need.

Hair salon business funding can be used to refurbish or expand your premises, upgrade or purchase hairdressing and beauty equipment, invest in marketing and online presence, develop e-commerce sales, hire additional staff, or cover day-to-day operational costs.

Getting a business loan for your hair or beauty salon is quick and straightforward. Simply complete our short online application form with a few basic business details. Once submitted, you’ll instantly receive a range of no-obligation loan quotes from multiple trusted lenders. You can then compare your options and choose the finance solution that best fits your salon’s needs. Applying is fast – it only takes a minute!

Quick Decision with No Obligation

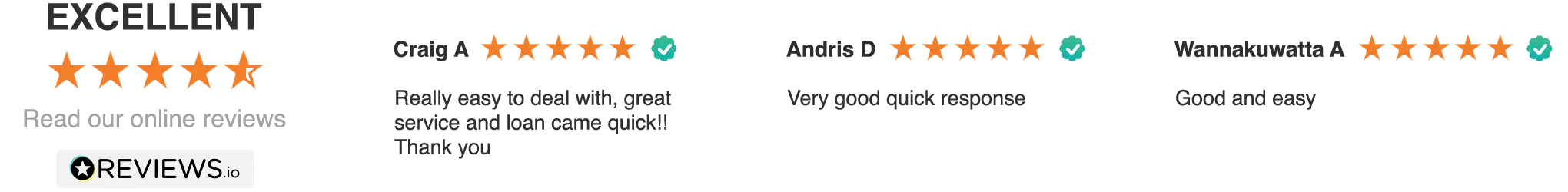

"We have helped many salon owners across the UK receive funding to grow"

£20+ Million

Total Funded to Businesses

90%

Application Approval Rate

It's as easy as 1-2-3!

The process is fast, simple and straightforward. It's hassle-free, meaning there's no complicated paperwork to complete so you can focus on growing your business.

1

Apply online in minutes

Apply online for a cash advance from £3,000 up to £300,000 for any business purpose.

2

Get funded in 24 hours*

The merchant cash advance can be with you in as little as 24 hours* after approval.

3

Repay only when you sell

You simply pay back a small percentage of your future card sales as they happen. You only repay when you sell.

Quick Decision with No Obligation