Flexible pharmacy finance made simple

If your pharmacy or health business is looking for a business loan to expand, stock a wider range of medications, upgrade equipment, or hire additional pharmacists and staff, a merchant cash advance can provide the fast and flexible capital needed to grow.

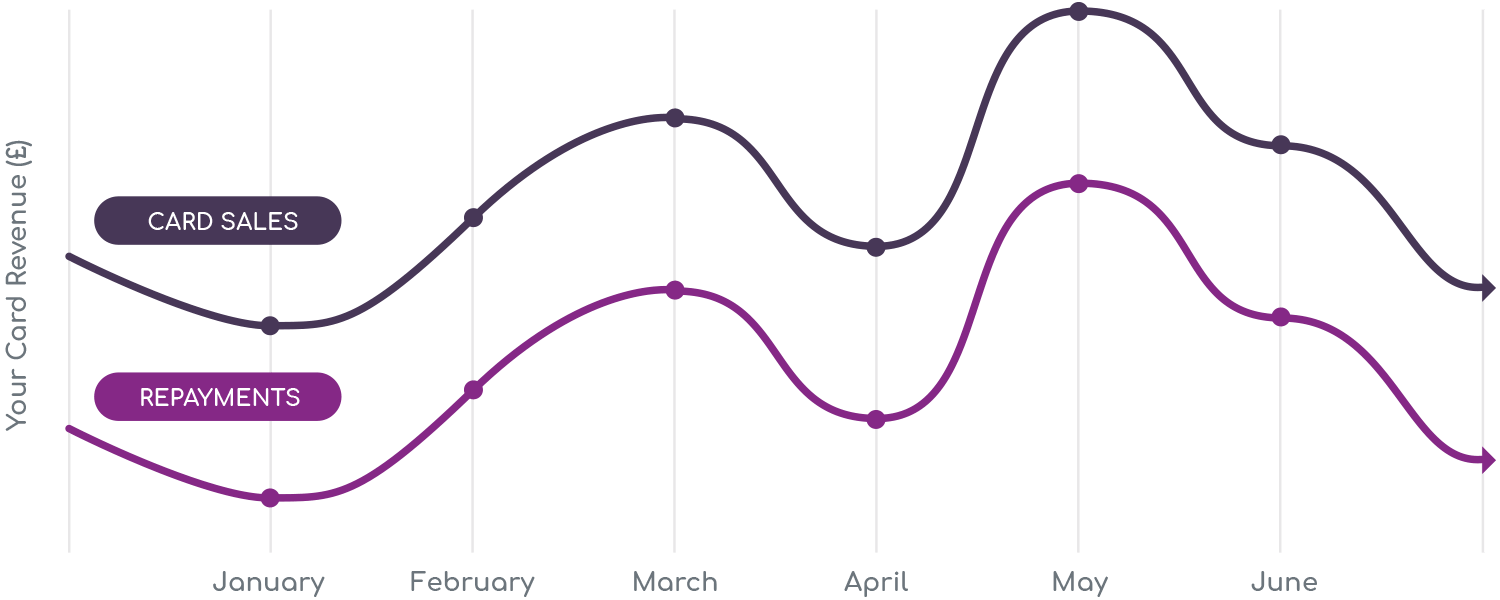

Works with your card sales

Unlock funding from £3,000 up to £300,000 against your customer card sales.

Flexible repayments

Automatically repay a small percentage when customers purchase by card – There are no fixed payments.

No asset security required

The advance is unsecured, so your business assets are safe.

Fast funding

A quick decision and process mean you can access your money in just 24 hours* after approval.

No hidden costs

The cost of the finance is made clear to you upfront. There are no hidden costs, confusing APR’s or other nasty charges.

Apply online 24/7

Apply at any time - We can process your application 24 hours a day.

Quick Decision with No Obligation

Boost the financial health of your pharmacy with business funding

According to the General Pharmaceutical Council, there are currently 13,268 registered pharmacies in England, Wales and Scotland. In such a competitive sector, pharmacies must adapt quickly, innovate, and find ways to stand out. That’s where a merchant cash advance, a flexible type of unsecured business funding, can make a real difference.

Whether you’re expanding your pharmacy, purchasing new stock, upgrading essential equipment, hiring staff, or managing cash flow, a merchant cash advance provides fast access to the working capital your business needs to grow and stay competitive.

Because many pharmacies and health shops rely heavily on card payments, this type of funding is ideal. It allows you to release capital based on your card sales, with repayments that automatically adjust in line with your daily or monthly revenue. Unlike traditional business loans with fixed repayment terms, a merchant cash advance offers flexibility and peace of mind.

So, whether you run a small chemist, large pharmacy or an independent health and wellness store specialising in sports nutrition or supplements, we can help you access the quick, hassle-free funding you need to thrive.

Ready to get started? Complete our simple online application form to see if your pharmacy business qualifies for funding today!

Apply NowQuick Decision with No Obligation

A pharmacy business loan can be used for a variety of purposes:

- Working capital to manage and support day-to-day operating expenses

- Hire new staff such as pharmacists, technicians, medicine counter assistants and other support staff

- Opening new pharmacy locations or renovating your existing health and wellness store

- Emergency funding to help with unexpected repairs and maintenance to equipment and buildings

- Upgrade existing equipment, such as prescription dispensing systems, to help increase efficiency

- Building an online health store to reach a wider audience

- Launch marketing campaigns to promote your services and special offers on products

- Stock up with a broader range of medications, supplements, vitamins, sports nutrition and other healthcare products

- Funding to help expand into new complementary health services

A pharmacy business loan is a type of financing specifically designed to support pharmacies and healthcare-related businesses in the UK. These loans provide the working capital you need to manage cash flow, purchase stock, invest in new equipment, or expand your pharmacy. Whether you’re an independent chemist or part of a small pharmacy chain, a business loan can help your business stay competitive and continue delivering essential healthcare services to your community.

Here at MLA, we offer a merchant cash advance, a type of business loan where a pharmacy receives a lump sum of capital upfront in exchange for a small portion of its future card sales.

Repayments are tied to the pharmacy's daily card sales. For example, instead of fixed monthly payments like a conventional business loan, an agreed percentage (usually ranging from 10% to 25%) of daily card sales is automatically collected by the lender. This means that on days with higher sales, the repayment amount is higher, and on slower days, it's lower.

Merchant cash advances typically have shorter terms compared to traditional loans. There's no 'fixed' term length; your daily card transactions or overall sales revenue will determine the repayment duration. Typically, this flexible repayment model can range from around 4 to 12 months, though this will vary based on your business performance and the agreement between the provider.

The amount your pharmacy business can borrow will depend upon your monthly card revenue and affordability. Generally, you can borrow up to one month's card revenue, so for example, if your pharmacy processes £10,000 a month on card, you can borrow up to £10,000 or more depending on your business.

We offer advances from £3,000 up to £300,000. To find out how much you could qualify for, apply online today!

If you're considering applying for business financing, your pharmacy or health shop will need to meet this minimum criteria:

- You are a Limited company or soletrader based in the UK

- You are trading with at least 3 months card payment history

- You must accept card payments, either in-person via a card terminal or online

- Your monthly card sales should exceed £3000

If you meet the criteria, don't hesitate to submit your online application today!

Yes, if your pharmacy or health store sells goods online, we can certainly help. Whether you need capital to expand your e-commerce operations, invest in marketing, or manage inventory, our business finance is designed to support all types of e-commerce retail businesses in the health and wellness sector.

Apply now to see how much you can borrow and take your online business to the next level.

Quick Decision with No Obligation

"We have helped many Pharmacies and Health stores across the UK receive funding to grow"

£20+ Million

Total Funded to Businesses

90%

Application Approval Rate

It's as easy as 1-2-3!

The process is fast, simple and straightforward. It's hassle-free, meaning there's no complicated paperwork to complete so you can focus on growing your business.

1

Apply online in minutes

Apply online for a cash advance from £3,000 up to £300,000 for any business purpose.

2

Get funded in 24 hours*

The merchant cash advance can be with you in as little as 24 hours* after approval.

3

Repay only when you sell

You simply pay back a small percentage of your future card sales as they happen. You only repay when you sell.

Quick Decision with No Obligation